🏵

WITH utterly grave disappointment, we learn that the widely-admired heir to the British throne may not be as earnestly concerned for the preservation of the environment as much as he is probably concerned with the preservation of his secret, offshore investments.

This latest discovery - the so-called Paradise Papers - made by the International Consortium of Investigative Journalists - a grouping that Clare Rewcastle Brown and Sarawak Report are conspicuously not invited to - reveals how the Prince stands to gain with every "pro-rainforest" speech that he gives in public, due to his financial interest in a carbon-swapping company.

In fact, according to the news reports that broke yesterday, the Prince seemed to have only started campaigning specifically on a "pro-rainforest" platform, after he had diverted investment in the said company.

It is also known that the Prince personally oversees the investment made by the Duchy of Cornwall, which plays the role of his Dukedom's incorporated body.

It is also worth noting that somehow, Clare Rewcastle Brown's brother-in-law is implicated in this story, and we also wonder how far into this is Clare herself involved?

What we do know is that she issued a protest over the recent Royal Visit, but the whole pile of horse-patootie that she wrote at length, seem to cover every other possible and speculative allegation, yet this particular credible one isn't mentioned.

We surmise that this is either due to her being complicit, and hence diversionary, or she simply has no clue, and truly is resorting to spinning old wives' tales just to keep that lying ragheap Sarawak Report relevant.

We share this latest development while we number the days of Clare Rewcastle Brown and her unscrupulous associates.

As for the Prince's credibility, we are certain to take each and every references to the rainforest that His Highness makes with a pinch of financial and former-colonial salt, and will take HH's words 'under advisement', as long as it is clearly beneficial to the rainforest - with no financial strings attached.

Having said that, we express our disappointment that the Prince came and went from Sarawak giving us the impression that his concern for our development is out of HH's on sincerity and inculcated values, bereft of financial considerations - as befitting an heir to a once-great Sovereign throne.

We also note that although the Prince has paid taxes on his secret earnings, the fact remains that his modus operandi in concealing the prospect of his personal financial gain over his charitable and social works - while acting completely independent - is alarming and unethical to say the least.

We hope Sarawakians remain ever-vigilant of these self-interested actors out to line their own pockets, while pretending to care about us and our environment.

We hope Sarawakians remain ever-vigilant of these self-interested actors out to line their own pockets, while pretending to care about us and our environment.

👇🏽

– - –

1.

2. RELATED: PARADISE PAPERS: PRINCE CHARLES LOBBIED ON CLIMATE CHANGE 'WITHOUT DISCLOSING INVESTMENTS'

3. RELATED: PARADISE PAPERS | PRINCE CHARLES'S PRIVATE ESTATE TRIPLE OFFSHORE INVESTMENT IN JUST OVER A YEAR

4. RELATED: PRINCE CHARLES 'LOBBIED FOR CLIMATE CHANGE WITHOUT DISCLOSING OFFSHORE FINANCIAL INTEREST'

5. RELATED: CHARLES AND CAMILLA LEAVE LASTING IMPRESSION DURING MAIDEN SARAWAK VISIT

– - –

PARADISE PAPERS: PRINCE CHARLES LOBBIED ON CLIMATE POLICY AFTER SHARES PURCHASE

REPORTED BY BBC

Prince Charles campaigned to alter climate-change agreements without disclosing his private estate had an offshore financial interest in what he was promoting, BBC Panorama has found.

The Paradise Papers show the Duchy of Cornwall in 2007 secretly bought shares worth $113,500 in a Bermuda company that would benefit from a rule change.

The prince was a friend of a director of Sustainable Forestry Management Ltd.

The Duchy of Cornwall says he has no direct involvement in its investments.

A Clarence House spokesman said the Prince of Wales had "certainly never chosen to speak out on a topic simply because of a company that it [the Duchy of Cornwall] may have invested in".

He added: "In the case of climate change his views are well-known, indeed he has been warning of the threat of global warming to our environment for over 30 years.

"Carbon markets are just one example that the prince has championed since the 1990s and which he continues to promote today."

'Conflict of interest'

He added Prince Charles was "free to offer thoughts and suggestions on a wide range of topics" and "cares deeply" about the issue of climate change but "it is for others to decide whether to take the advice".

Sir Alistair Graham, former chairman of the Committee on Standards in Public Life, said Prince Charles's actions amounted to a serious conflict of interest.

He said: "There's a conflict of interest between his own investments of the Duchy of Cornwall and what he's trying to achieve publicly.

"And I think it's unfortunate that somebody of his importance, of his influence, becomes involved in such a serious conflict."

The leaked documents held by law firm Appleby show the Duchy of Cornwall also made offshore investments totalling $3.9m in four funds in the Cayman Islands in 2007. This is legal and there is no suggestion of tax avoidance.

A Duchy of Cornwall spokesman said Prince Charles voluntarily pays income tax on any revenue from his estate.

He added the estate's investments "do not derive any tax advantage whatsoever based on their location or any other aspect of their structure and there is no loss of revenue to HMRC as a result".

Kept confidential

The prince began campaigning for changes to two important environmental agreements weeks after Sustainable Forestry Management (SFM) sent his office lobbying documents.

Prince Charles's estate almost tripled its money in just over a year although it is not clear what caused the rise in the share value. Despite his high profile campaign, the environmental agreements were not changed.

The documents reveal the Duchy of Cornwall, an £896m private estate that provides Prince Charles with an income and which he is said to be "actively involved" in running, bought the shares in February 2007. At the time $113,500 was worth about £58,000.

One of SFM's directors was the late Hugh van Cutsem, a millionaire banker and conservationist who has been described as the one of the Prince's closest friends.

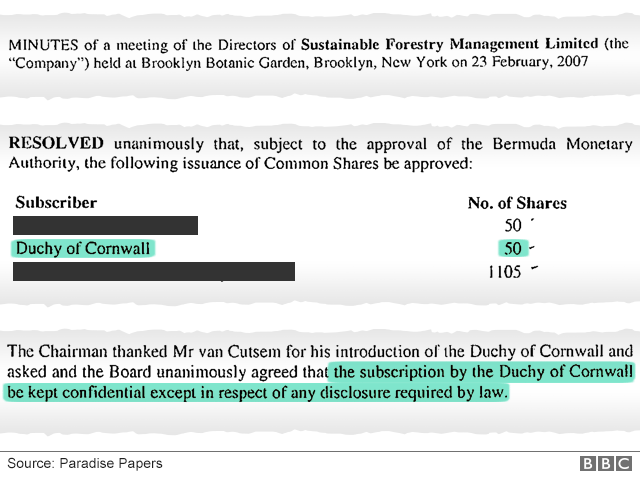

The minutes of a company board meeting that approved the Duchy's shareholding say: "The Chairman thanked Mr van Cutsem for his introduction of the Duchy of Cornwall and the Board unanimously agreed that the subscription by the Duchy of Cornwall be kept confidential except in respect of any disclosure required by law."

Source document

Change in policy

SFM traded in carbon credits, a market created by international treaties to tackle global warming.

It wanted to trade in credits from "tropical and subtropical forests" but was hampered by two important climate change agreements, the EU's Emissions Trading Scheme (EU ETS) and the Kyoto Protocol, which largely excluded carbon credits from rainforests.

When the Duchy bought its shares, SFM was lobbying for a "change in policy" on carbon credits, the documents show.

It had hired the US former lead negotiator on the Kyoto Protocol, Stuart Eizenstat "to lobby for inclusion of forest carbon credits" in new US and EU laws and regulations.

Board minutes from February 2007 show SFM was also taking "steps to influence events to support forest credits" ahead of Kyoto Protocol meetings at the end of the year.

On 6 June 2007, four months after the Duchy bought its shares, Mr van Cutsem asked SFM's chairman to send lobbying documents to the office of the prince.

Under the heading "public policy and advocacy", minutes of a board meeting held in Paris say "the chairman referred the committee to the bundle of materials which had been prepared by the company for various policymakers... Mr van Cutsem... asked that a set of documents be prepared for the Prince of Wales office. The chairman undertook to do so".

Rainforests project

Four weeks later, on 2 July, Prince Charles, made a speech that criticised the EU ETS and Kyoto Protocol for excluding carbon credits from rainforests, and called for change.

Speaking at the Business in the Community Awards Dinner, the prince said: "As the Kyoto protocol now stands tropical rainforest nations have no way of earning credits from their standing forests other than by cutting them down and planting new ones," he said.

"The European Carbon Trading Scheme excludes carbon credits for forests from developing nations. This has got be wrong and we must urge the international community to work together to redress these failings urgently."

|

| The campaigning was taking place ahead of meetings about the Kyoto Protocol. Photo: Getty |

In October 2007, he launched the Prince's Rainforests Project, which aimed to "increase global recognition of the contribution of tropical deforestation to climate change and to find ways to make the rainforests worth more alive than dead."

In a speech to mark the launch, he said: "The Kyoto Protocol does not have a mechanism to protect standing rainforests.

"Credits are available for afforestation and reforestation projects, but not for maintaining an old growth forest. And the European Trading Scheme excludes carbon credits for forestry in developing nations altogether… surely we have to accept that the pressing urgency of climate change requires a response that embraces rather than excludes primary tropical forests?"

Panorama has been unable to find evidence of any speeches the prince made before 2008 about changing Kyoto and EU ETS to include carbon credits for rainforests. The programme asked the prince's office for any such speeches but they did not respond.

'Helping hand'

Over the next six months, the future king made further speeches and videos about rainforests.

In a video released in January 2008, the prince said: "The immediate priority, I believe, is the need to develop a new credit market which will give a true value to carbon and the ecosystem services the rainforests provide the rest of the world."

In February 2008, he reportedly discussed rainforests at a private meeting with the then Prime Minister Gordon Brown.

Days later, he met with the then President of the European Commission, Jose Manuel Barroso, and the EU's environment, energy, trade and agriculture commissioners.

In a speech to 150 MEPs, he said: "I have great hopes that the next version of the European Emissions Trading scheme might extend the helping and very visible hand of a market approach to assist in keeping the rainforests standing… the lives of billions of people depend on your response and none of us will be forgiven by our children and grandchildren if we falter and fail."

On 18 June 2008, as the global financial crash was beginning, the Duchy sold its stake in SFM.

The documents show it was paid $325,000 for the 50 shares.

SFM is no longer in existence.

Sir Alistair Graham says Prince Charles

should be accountable to public scrutiny.

– BBC

The Duchy was established in 1337 and uses the income to fund the public, private and charitable activities of the Prince of Wales and his children. Its accounts are independently audited and put before Parliament.

A Duchy of Cornwall spokesman said the estate followed a "responsible investment policy which governs the sectors that it may invest in".

The Paradise Papers documents also showed about £10m of the Queen's private money was invested offshore in 2004-2005 in Bermuda and the Cayman Islands.

('Paradise Papers: Prince Charles Lobbied on Climate Change Policy After Shares Purchase.' – BBC, November 7, 2017)

– - –

1. PARADISE PAPERS: PRINCE CHARLES LOBBIED FOR CLIMATE CHANGE POLICY AFTER SHARES PURCHASE

2.

3. RELATED: PARADISE PAPERS | PRINCE CHARLES'S PRIVATE ESTATE TRIPLE OFFSHORE INVESTMENT IN JUST OVER A YEAR

4. RELATED: PRINCE CHARLES 'LOBBIED FOR CLIMATE CHANGE WITHOUT DISCLOSING OFFSHORE FINANCIAL INTEREST'

5. RELATED: CHARLES AND CAMILLA LEAVE LASTING IMPRESSION DURING MAIDEN SARAWAK VISIT

– - –

RELATED: PARADISE PAPERS: PRINCE CHARLES CAMPAIGNED ON CLIMATE CHANGE 'WITHOUT DISCLOSING INVESTMENTS'The Duchy of Cornwall says the Prince had no direct involvement in any of its investments following the latest tax revelation.

REPORTED BY SKY NEWS

The so-called Paradise Papers have revealed Prince Charles allegedly campaigned to alter climate-change agreements without disclosing the offshore financial interests of his estate.

The leaked documents showed the Duchy of Cornwall estate secretly bought shares worth $113,500 (£86,000) in a firm in Bermuda in 2007 that could benefit from changes in rules, according to the BBC's Panorama.

It claimed the Prince of Wales was a friend of one of the directors of forest management company Sustainable Forestry Management Ltd.

But the Duchy of Cornwall said Prince Charles had no direct involvement in any of its investments.

A spokesman for Clarence House said he had "never chosen to speak out on a topic simply because of a company The Duchy may have invested in".

He added: "In the case of climate change his views are well known, indeed he has been warning of the threat of global warming to our environment for over 30 years.

"Carbon markets are just one example that the Prince has championed since the 1990s and which he continues to promote today."

A Duchy of Cornwall spokesman said the estate had a "responsible investment policy" and that its accounts were "independently audited and presented to Parliament every year".

He added: "These investments do not derive any tax advantage whatsoever based on their location or any other aspect of their structure and there is no loss of revenue to HMRC as a result."

The revelation comes after the Queen's private estate was accused of investing millions of pounds in offshore tax havens.

The Paradise Papers leak revealed the investments made by the Duchy of Lancaster but there is nothing to suggest any of them were illegal.

|

| The Queen's estate is accused of investing millions of pounds in offshore tax havens. Photo: Sky News |

Tech giant Apple and Formula One champion Lewis Hamilton have also been named among those allegedly avoiding tax.

Apple is accused of holding most of its offshore funds in Jersey, where taxes are lower. The firm is said to have moved its money there when Ireland changed its tax rules in 2015.

But the iPhone maker insists its new tax structure has not reduced the amount of tax it pays and that it remains the world's largest taxpayer.

The leaked documents appear to show Hamilton avoided tax on a private jet worth £16.5m, which he imported into the Isle of Man.

His advisers set up a leasing deal which entitled Hamilton to receive a VAT refund of £3.3m on the jet on the basis it was used for business. But allegations surfaced that it was also used for personal use.

The Mercedes driver's lawyers said the tax structure was found to be lawful after it was reviewed by a barrister and they deny anything illegal has taken place.

('Paradise Papers: Prince Charles Campaigned on Climate hange "Without Disclosing Investments".' – Sky News, November 7, 2017)

– - –

1. PARADISE PAPERS: PRINCE CHARLES LOBBIED FOR CLIMATE CHANGE POLICY AFTER SHARES PURCHASE

2. RELATED: PARADISE PAPERS: PRINCE CHARLES LOBBIED ON CLIMATE CHANGE 'WITHOUT DISCLOSING INVESTMENTS'

3.

4. RELATED: PRINCE CHARLES 'LOBBIED FOR CLIMATE CHANGE WITHOUT DISCLOSING OFFSHORE FINANCIAL INTEREST'

5. RELATED: CHARLES AND CAMILLA LEAVE LASTING IMPRESSION DURING MAIDEN SARAWAK VISIT

– - –

RELATED: PARADISE PAPERS | PRINCE CHARLES'S PRIVATE ESTATE TRIPLE OFFSHORE INVESTMENT IN JUST OVER A YEAR

Questions about conflict as heir to throne continued touting carbon offsetting while investing in it.

Questions about conflict as heir to throne continued touting carbon offsetting while investing in it.

REPORTED BY CBC NEWS

|

| Prince Charles visits the MacRitchie Reservoir Park on October 31 in Singapore. Photo: Chris Jackson/Getty |

The Queen's forays into offshore investing may have been the Paradise Papers' biggest surprise, but in terms of impact they are easily eclipsed by a single, apparently very profitable deal made by Prince Charles.

Leaked documents show that in just one buy-and-sell transaction, the Prince of Wales's private estate, the Duchy of Cornwall, appears in just over a year to have tripled an estimated $100,000 US investment in an offshore company co-run by one of his closest friends.

Leaked board minutes in the Paradise Papers show that from the purchase, in February 2007, the company, which specializes in carbon offsetting, also committed to treating his stake as a sensitive secret.

All the while, the heir to the British throne continued to publicly promote carbon offsetting — a subject he's repeatedly spoken about — even as he was invested in it.

None of the new revelations, which show the prince had millions more invested offshore, suggest illegal action. But they raise questions about the rules surrounding conflict of interest where royals are concerned, and, for the second time this week about whether senior royal figures are transparent enough about their sources of income — especially if they're investing offshore.

"The real problem with these revelations even if Charles had no knowledge whatsoever of what was going on, is that the optics are terrible," said David McClure, a royal finances expert, told CBC News. "It paints the future king of Britain in a bad light. It damages the brand of the British monarchy."

The peek into the prince's offshore dealings comes from a massive offshore leak obtained by the German newspaper Suddeutsche Zeitung and provided to the International Consortium of Investigative Journalists, which organized a global collaboration that included the Guardian newspaper and the BBC in the United Kingdom as well as CBC News in Canada.

Indirect stake

Through the Paradise Papers, it emerged for the first time on Sunday that the Queen had about 10 million pounds in investments offshore, including an indirect stake in a controversial chain of rent-to-own stores that just last month regulators ruled was not a responsible lender.

The Queen's private estate, the Duchy of Lancaster, said it did not know it held stakes in the chain until questions came from journalists.

Documents show Prince Charles's private estate purchased 50 shares in early 2007 in the Bermuda-based Sustainable Forestry Management Ltd., a now-defunct company that specialized in carbon offsetting. The price tag is estimated to have been in the $100,000 US ballpark.

Nearly a year and a half after the purchase, in June 2008, another document indicates the Duchy of Cornwall transferred its shares to another buyer. The purchase price is noted as $325,000, more than triple the initial investment.

The Prince of Wales has long spoken out in favour of sustainable forestry and carbon offsetting, and that did not change during the period when he held his stake in the company.

A speech prepared for Prince Charles for a July 2, 2007 event says: "We need to develop a new credit market which will give a true value to carbon and the ecosystem services that rainforests provide the rest of the world."

The BBC reported that the prince gave three major speeches which touch on the subject in the seven months after his private estate acquired the stakes.

Speaking out on climate change

A spokesperson for Clarence House told CBC News in a statement: "He has certainly never chosen to speak out on a topic simply because of a company that [the Duchy] may have invested in."

"Carbon markets are just one example" of actions the prince has championed to "slow or halt the damage that is being done" by climate change, the spokesperson said.

|

| Charles chats with Hugh van Cutsem, right, president of the Moorcroft and District Agricultural Society at its annual show in Mossdale, North Yorkshire. Photo: PA/Getty |

In a Guardian newspaper investigation, minutes were spotted from a meeting of the board of directors of Sustainable Forestry Management Ltd. on February 23, 2007, indicating the purchase was made possible with help from Hugh van Cutsem.

He and Prince Charles had been friends since they attended university in the 1960s, and the van Cutsem family has been a fixture in Prince Charles's life ever since. The elder van Cutsem died in 2013.

In the documents, the chairman is quoted as having "thanked Mr. van Cutsem for his introduction of the Duchy of Cornwall and asked that the board unanimously agree that the subscription by the Duchy of Cornwall be kept confidential except in respect of any disclosure required by law."

Another document says van Cutsem "asked that a set of documents be prepared for the Prince of Wales office" about a scheme the company supported advocating the use of carbon credits.

In a statement, a Duchy of Cornwall spokesperson told CBC News the Prince of Wales "does not have any direct involvement in the investment decisions taken by the Duchy. These are the responsibility of the Duchy itself."

The spokesperson added the investments "do not derive any tax advantage whatsoever."

The Duchy of Cornwall was set up 680 years ago to provide a private income to the heir to the throne. Its net assets are in the range of 896 million pounds.

Tax exempt but paying taxes

Prince Charles and his Duchy are tax exempt, but like the Queen, he has been voluntarily paying income tax since 1993.

The Duchy owns mostly commercial and residential real estate as well as land, some of which has been harnessed to help produce the Prince of Wales's profitable organic food enterprise.

The Duchy also has a financial investment portfolio. Its website says the prince is "actively involved in running the Duchy."

There have been calls in the past for more transparency in the Duchy's workings and more scrutiny of the details of generating an income for Prince Charles.

In 2016-17, the Duchy paid Prince Charles — who is also the Duke of Cornwall, the longest serving in the title ever — 20.7 million pounds in income, a raise of 1.2 per cent over the previous year.

The website says the income is there for him to spend as he sees fit, but that Prince Charles uses "a substantial proportion of his income" to fund the "public and charitable work as well as the public and private lives of his family" including his wife, Camilla, the Duchess of Cornwall; his son Prince William and his family; and his son Prince Harry.

Prince Charles is not entitled to access the Duchy's capital holdings, which will be passed on to William, the likely next Duke of Cornwall, when his father takes the throne.

('Paradise Papers | Prince Charles's Private Estate Triple Offshore Investment in Just Over a Year.' – CBC News, November 7, 2017)

– - –

1. PARADISE PAPERS: PRINCE CHARLES LOBBIED FOR CLIMATE CHANGE POLICY AFTER SHARES PURCHASE

2. RELATED: PARADISE PAPERS: PRINCE CHARLES LOBBIED ON CLIMATE CHANGE 'WITHOUT DISCLOSING INVESTMENTS'

3. RELATED: PARADISE PAPERS | PRINCE CHARLES'S PRIVATE ESTATE TRIPLE OFFSHORE INVESTMENT IN JUST OVER A YEAR

4.

5. RELATED: CHARLES AND CAMILLA LEAVE LASTING IMPRESSION DURING MAIDEN SARAWAK VISIT

– - –

RELATED: PRINCE CHARLES 'LOBBIED FOR CLIMATE POLICY CHANGE WITHOUT DISCLOSING OFFSHORE FINANCIAL INTEREST'

Prince's actions amount to ‘serious conflict of interest’, says former chairman of the Committee on Standards in Public Life

Prince's actions amount to ‘serious conflict of interest’, says former chairman of the Committee on Standards in Public Life

REPORTED BY THE INDEPENDENT

Prince Charles campaigned to alter climate change agreements without disclosing his estate’s financial interest in such a rule change, leaks from the Paradise Papers indicate.

In 2007, the Prince of Wales reportedly bought shares worth $113,500 (£83,600), in a Bermuda-based company run by one of his best friends, Hugh van Cutsem. That friend was also a director of Sustainable Forestry Management, the board of which invested invested in land to protect it from deforestation.

The purchase of the shares was regarded as highly sensitive, The Guardian reports, and members of Sustainable Forestry Management’s board were reportedly sworn to secrecy about the Prince’s involvement.

The Prince of Wales has long been a vocal speaker on the issue of climate change.

According to the BBC, he mounted a high profile campaign for changes to two major environmental agreements just weeks after Sustainable Forestry Management sent his office lobbying documents.

Four weeks after purchasing the shares, Prince Charles called for the Kyoto Protocol and the EU’s emissions trading system to recognise carbon credits from rainforests, saying it was “wrong”.

In October 2007, he launched the Prince’s Rainforest Project, which aimed to highlight the impact of tropical deforestation. And in January 2008 he released a video in which he called for new ways of supporting rainforests.

The BBC’s Panorama programme said it was unable to find any evidence of speeches made by the Prince about changing Kyoto, or EU ETS policy about rainforests, prior to purchasing the shares.

Sir Alistair Graham, former chairman of the Committee on Standards in Public Life, said the Prince’s actions amounted to a “serious” conflict of interest.

According to the BBC, he said: “There's a conflict of interest between his own investments of the Duchy of Cornwall, and what he’s trying to achieve publicly.

“And I think it’s unfortunate that somebody of his importance, of his influence, becomes involved in such a serious conflict.”

Labour MP Margaret Hodge said the revelations made clear the need for “proper transparency”.

She told The Guardian: “It seems clear to me that Prince Charles could not have known or understood the nature of the investment in his friend’s company,” she said.

“What is clear is that there should be proper transparency of all investments made by the Duchy of Cornwall, that the Prince of Wales should not be involved in investment decisions and that the Treasury should monitor the investments to ensure that the reputation and integrity of our royal family is protected.”

The Duchy of Cornwall said the Prince has no direct involvement in its investments.

A Clarence House spokesman said Prince Charles had “certainly never chosen to speak out on a topic simply because of a company that it may have invested in”.

“In the case of climate change his views are well known, indeed he has been warning of the threat of global warming to our environment for over 30 years.

“Carbon markets are just one example that the prince has championed since the 1990s, and which he continues to promote today.”

('Prince Charles 'Lobbied for Climate Change Policy Change Without Disclosing Offshore Financial Interest.' – The Independent, )

– - –

1. PARADISE PAPERS: PRINCE CHARLES LOBBIED FOR CLIMATE CHANGE POLICY AFTER SHARES PURCHASE

2. RELATED: PARADISE PAPERS: PRINCE CHARLES LOBBIED ON CLIMATE CHANGE 'WITHOUT DISCLOSING INVESTMENTS'

3. RELATED: PARADISE PAPERS | PRINCE CHARLES'S PRIVATE ESTATE TRIPLE OFFSHORE INVESTMENT IN JUST OVER A YEAR

4. RELATED: PRINCE CHARLES 'LOBBIED FOR CLIMATE CHANGE WITHOUT DISCLOSING OFFSHORE FINANCIAL INTEREST'

5.

– - –

RELATED: CHARLES AND CAMILLA LEAVE LASTING IMPRESSION DURING MAIDEN SARAWAK VISIT

REPORTED BY NEW STRAITS TIMES

SANTUBONG, November 6, 2017 –

|

| Prince Charles and Camilla in Sarawak, publicly expressing his concerns over the rainforest. Photo: NST/BERNAMA |

Britain’s royal couple, Prince Charles and his wife Camilla, left a lasting impression on the people in the state during their maiden visit to Sarawak today.

The Prince of Wales and the Duchess of Cornwall, who is on their fifth day in Malaysia, kicked-off their whirlwind tour to the state by visiting the Sarawak Cultural Village, nestled at the foothills of Mount Santubong here.

Accompanied by Deputy Minister in the Prime Minister’s Department Datuk Seri S. K. Devamany and State Tourism, Arts, Culture, Youth and Sports Minister Datuk Abdul Karim Rahman Hamzah, the royal couple were greeted upon arrival by a cultural performance from dancers clad in colourful traditional costumes.

Prince Charles and Camilla spent almost an hour visiting attractions available at the cultural village, dubbed a ‘living museum’ displaying Sarawak’s diverse and rich cultural heritage.

The Prince of Wales also displayed his skills at using the Penan blowpipes when he visited the ‘Rumah Penan’ (Penan hut). He and Camilla also crossed a man-made lake via a bamboo raft.

The heir to the British throne also had a closed-door dialogue session with six community leaders representing the major ethnic groups in the state.

Dayak Bidayuh National Association (DBNA) president Datuk Ik Pahon Joyik said Prince Charles was very passionate when the latter spoke about the preservation of indigenous cultures.

“He spoke at great length and shared his experience of preserving cultures and heritage among indigenous groups over the past 30 years.

“He also touched on the importance of pulling out all the stops to preserve Sarawak’s culture before it become extinct,” he said when met after the dialogue session.

Another community leader, Charlie Unggang, said Prince Charles was very humble and did his best to set everyone at ease.

“He was very down to earth and showed great interest in Sarawak’s heritage and issues related to the well-being and welfare of the people in the state,” said Charlie, who is DBNA deputy president.

Meanwhile, Ruekeith Jampong still cannot believe that he had attended a dialogue with the Prince of Wales.

“I am honoured to be part of the group who had this opportunity to attend a dialogue with British royalty. To be able to voice our opinions and for him to hear our views is an experience I will remember forever,” he said.

After concluding their visit to the cultural village, Prince Charles and Camilla later headed to the Semenggoh Wildlife Rehabilitation Centre in Semenggoh near here, where they were given a brief on the rehabilitation efforts of orangutan and other protected wildlife.

Prince Charles also stopped by the Kuching and Sarawak Biodiversity Centre.

Camilla, on the other hand, proceeded the Old Court House in the state capital to meet representatives of Purple Lily, non-governmental organisation.

The royal couple is scheduled to leave for Penang later today.

('Charles and Camilla Leave Lasting Impression During Maiden Sarawak Visit.' – New Straits Times, November 6, 2017)

👋🏽

– - –

The NINE QUESTIONS Blog will return with more facts.

– - –